Archive

Estimation accuracy in the (building|road) construction industry

Lots of people complain about software development taking longer than estimated. Are estimates in other industries more accurate, and do they contain patterns similar to those seen in software task estimates?

Readers will probably not be surprised to learn that obtaining estimate/actual data is as hard for other industries as it is for software.

Software engineering sometimes gets compared with building construction, in the sense that building construction is perceived as being straightforward and predictable. My tiny experience with building construction is that it is not as straightforward and predictable as outsiders think, a view echoed by the few people in the building industry I have spoken to.

I have found two building datasets, the supplementary material from: Forecasting the Project Duration Average and Standard Deviation from Deterministic Schedule Information (the 101 rows also include some service projects), and Ballesteros-Pérez kindly sent me the data for Duration and Cost Variability of Construction Activities: An Empirical Study which included 746 rows of road construction estimate/actual data from an unknown source. This data is for large projects, where those involved had to bid to get the work.

The following plot reminds us of how effort vs actual often looks like for short software tasks; it includes a fitted regression model and prediction intervals at one standard deviation (68.3%) and two standard deviations (95%); the faint grey line shows Estimate == Actual (post discussing the analysis and linking to code+data):

The data in the above plot is for small tasks, which did not involve bidding for the work.

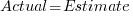

The following plot shows estimated vs actual duration for 101 construction projects. The red line has the form:  , i.e., average estimate is 9% lower than actual duration (blue line shows

, i.e., average estimate is 9% lower than actual duration (blue line shows  ; code+data).

; code+data).

The obvious differences are that the fitted line shows consistent underestimation (hardly surprising when bidding for work; 16% of estimates are greater than the actual), that the variance of project estimate/actual about the line is much smaller for building construction, and that the red/blue lines are essentially parallel (the exponent for software tasks is consistently around 0.85, rather than 1)

The following plot shows estimated vs actual for 746 road construction projects. The red line has the form:  , i.e., average estimate is 24% lower than actual duration (blue line shows

, i.e., average estimate is 24% lower than actual duration (blue line shows  ; code+data):

; code+data):

Again there is a consistent average underestimate (project bidding was via an auction process), the red/blue lines are essentially parallel, and while the estimate/actual variance is larger than for building construction only 1.5% estimates are greater than the actual.

Consistent underestimating is not surprising for external projects awarded via a bidding process.

The unpredicted differences are the much smaller estimate/actual variance (compared to software), and the fitted line running parallel to  .

.

Evolution of the DORA metrics

There is a growing buzz around the DORA metrics. Where did the DORA metrics come from, what are they, and are they useful?

The company DevOps Research and Assessment LLC (DORA) was founded by Nicole Forsgren, Jez Humble, and Gene Kim in 2016, and acquired by Google in 2018. DevOps is a role that combines software development (Dev) and IT operations (Ops).

The original ideas behind the DORA metrics are described in the 2015 paper DevOps: Profiles in ITSM Performance and Contributing Factors, by Forsgren and Humble. The more well known Accelerate book, published in 2018, is an evangelistic reworking of the material, plus some business platitudes extolling the benefits of using a lean process.

The 2015 paper approaches the metric selection process from the perspective of reducing business costs, and uses a data driven approach. This is how metric selection should be done, and for the first seven or eight pages I was cheering the authors on. The validity of a data driven approaches depends on the reliability of the data and its applicability to the questions being addressed. I don’t think that the reliability of the data used is sufficient to support the conclusions being drawn from it. The data used is the survey results behind the Puppet Labs 2015 State of DevOps Report; the 2018 book included data from the 2016 and 2017 State of DevOps reports.

Between 2015-2018, DORA is more a way of doing DevOps than a collection of metrics to calculate. The theory is based on ideas from the Economic Order Quantity model; this model is used in inventory management to calculate the number of items that should be held in stock, to meet production demand, such that stock holding costs plus item reordering costs are minimised (when the number of items in stock falls below some value, there is an optimum number of items to reorder to replenish stocks).

The DORA mapping of the Economic Order Quantity model to DevOps employs a rather liberal interpretation of the concepts involved. There are three fundamental variables:

- Batch size: the quantity of additions, modifications and deletions of anything that could have an effect on IT services, e.g., changes to code or configuration files,

- Holding cost: the lost opportunity cost of not deploying work that has been done, e.g., lost business because a feature is not available or waste because an efficiency improvement is not used. Cognitive capitalism also has the lost opportunity cost of not learning about the impact of an update on the ecosystem,

- Transaction cost: the cost of building, testing and deploying to production a completed batch.

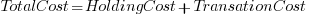

The aim is to minimise  .

.

So far, so good and reasonable.

Now the details; how do we measure batch size, holding cost and transaction cost?

DORA does not measure these quantities (the paper points out that deployment frequency could be treated as a proxy for batch size, in that as deployment frequency goes to infinity batch size goes to zero). The terms holding cost and transaction cost do not appear in the 2018 book.

Having mapped Economic Order Quantity variables to software, the 2015 paper pivots and maps these variables to a Lean manufacturing process (the 2018 book focuses on Lean). Batch size is now deployment frequency, and higher is better.

Ok, let’s follow the pivoted analysis of Lean ideas applied to software. The 2015 paper uses cluster analysis to find patterns in the 2015 State of DevOps survey data. I have not seen any of the data, or even the questions asked; the description of the analysis is rather sketchy (I imagine it is similar to that used by Forsgren in her PhD thesis on a different dataset). The report published by Puppet Labs analyses the data using linear regression and partial least squares.

Three IT performance profiles are characterized (High, Medium and Low). Why three and not, say, four or five? The papers simply says that three ’emerged’.

The analysis of the Puppet Labs 2015 survey data (6k+ responses) essentially takes the form of listing differences in values of various characteristics between High/Medium/Low teams; responses came from “technical professionals of all specialities involved in DevOps”. The analysis in the 2018 book discussed some of the between year differences.

My experience of asking hundreds of people for data is that most don’t have any. I suspect this is true of those who answered the Puppet Labs surveys, and that answers are guestimates.

The fact that the accuracy of analysis of the survey data is poor does not really matter, because DORA pivots again.

This pivot switches to organizational metrics (from team metrics), becomes purely production focused (very appropriate for DevOps), introduces an Elite profile, and focuses on four key metrics; the following is adapted from Google:

- Deployment Frequency: How often an organization successfully releases to production,

- Lead Time for Changes: The amount of time it takes a commit to get into production,

- Change Failure Rate: The percentage of deployments causing a failure in production,

- Mean time to repair (MTTR): How long it takes an organization to recover from a failure in production.

Are these four metrics useful?

To somebody with zero DevOps experience (i.e., me) they look useful. The few DevOps people I have spoken to are talking about them but not using them (not least because they don’t have the data required).

The characteristics of the Elite/High/Medium/Low profiles reflects Google’s DevOps business interests. Companies offering an online service at a national scale want to quickly respond to customer demand, continuously deploy, and quickly recover from service outages.

There are companies where it makes business sense for DevOps deployments to occur much less frequently than at Google. I also know companies who would love to have deployment rates within an order of magnitude of Google’s, but cannot even get close without a significant restructuring of their build and deployment infrastructure.

Extracting numbers from a stacked density plot

A month or so ago, I found a graph showing a percentage of PCs having a given range of memory installed, between March 2000 and April 2020, on a TechTalk page of PC Matic; it had the form of a stacked density plot. This kind of installed memory data is rare, how could I get the underlying values (a previous post covers extracting data from a heatmap)?

The plot below is the image on PC Matic’s site:

The change of colors creates a distinct boundary between different memory capacity ranges, and it ought to be possible to find the y-axis location of each color change, for a given x-axis location (with location measured in pixels).

The image was a png file, I loaded R’s png package, and a call to readPNG created the required 2-D array of pixel information.

library("png")

img=readPNG("../rc_mem_memrange_all.png") |

Next, the horizontal and vertical pixel boundaries of the colored data needed to be found. The rectangle of data is surrounded by white pixels. The number of white pixels (actually all ones corresponding to the RGB values) along each horizontal and vertical line dramatically drops at the data image boundary. The following code counts the number of col points in each horizontal line (used to find the y-axis bounds):

horizontal_line=function(a_img, col)

{

lines_col=sapply(1:n_lines, function(X) sum((a_img[X, , 1]==col[1]) &

(a_img[X, , 2]==col[2]) &

(a_img[X, , 3]==col[3]))

)

return(lines_col)

}

white=c(1, 1, 1)

n_cols=dim(img)[2]

# Find where fraction of white points on a line changes dramatically

white_horiz=horizontal_line(img, white)

# handle when upper boundary is missing

ylim=c(0, which(abs(diff(white_horiz/n_cols)) > 0.5))

ylim=ylim[2:3] |

Next, for each vertical column of pixels, at each x-axis pixel location, the sought after y value occurs at the change of color boundary in the corresponding vertical column. This boundary includes a 1-pixel wide separation color, which creates a run of 2 or 3 consecutive pixel color changes.

The color change is easily found using the duplicated function.

# Return y position of vertical color changes at x_pos

y_col_change=function(x_pos)

{

# Good enough technique to generate a unique value per RGB color

col_change=which(!duplicated(img[y_range, x_pos, 1]+

10*img[y_range, x_pos, 2]+

100*img[y_range, x_pos, 3]))

# Handle a 1-pixel separation line between colors.

# Diff is used to find these consecutive sequences.

y_change=c(1, col_change[which(diff(col_change) > 1)+1])

# Always return a vector containing max_vals elements.

return(c(y_change, rep(NA, max_vals-length(y_change))))

} |

Next, we need to group together the sequence of points that delimit a particular boundary. The points along the same boundary are all associated with the same two colors, i.e., the ones below/above the boundary (plus a possible boundary color).

The plot below shows all the detected boundary points, in black, overwritten by colors denoting the points associated with the same below/above colors (code):

The visible black pluses show that the algorithm is not perfect. The few points here and there can be ignored, but the two blocks at the top of the original image have thrown a spanner in the works for some range of points (this could be fixed manually, or perhaps it is possible to tweak the color extraction formula to work around them).

How well does this approach work with other stacked density plots? No idea, but I am on the lookout for other interesting examples.

Multi-state survival modeling of a Jira issues snapshot

Work items in a formal development process progress through a series of stages, e.g., starting at Open, perhaps moving to Withdrawn or Merged with another item, eventually reaching Development, and finishing at Done (with a few being Reopened, i.e., moving back to the start of the process).

This process can be modelled as a Markov chain, provided data on each stage of the process is available, for each work item; allowing values such as average time spent in each state and transition probabilities to be calculated.

The Jira issue/task/bug/etc tracking system has an option to generate a snapshot of the current status of work items in the system. The snapshot information on each item includes: start-date, current-state, time-in-state, date-of-snapshot.

If we assume that all work items pass through the same sequence of states, from Open to Done, then the snapshot contains enough information to build a multi-state survival model.

The key information is time-in-state, which can be used to calculate the date/time when an item transitioned from its previous state to its current state, providing a required link between all states.

How is a multi-state survival model better than creating a distinct survival model for each state?

The calculation of each state in a multi-state model takes into account information from the succeeding state, i.e., the time-in-state value in the succeeding state provides timing (from the Start state) on when a work item transitioned from its previous state. While this information could be added to each of the distinct models, it’s simpler to bundle everything together in one model.

A data analysis article by Robert Krasinski linked to the data used 🙂 The data does not include a description of the columns, but most of the names appear self-explanatory (I have no idea what key might be). Each of the 3,761 rows includes a story-point estimate, team-id, and a tag name for the work item.

Building a multi-state model provides a means for estimating the impact of team-id and story-points on time-in-state. I would expect items with higher story-point estimates to spend longer in Development, but I’m not sure how much difference there will be on other states.

I pruned the 22 states present in the data down to the following sequence of 13. Items might be Withdrawn or Merged with others items at any time, but I’m keeping things simple. These two states should also be absorbing in that there is no exit from them, I faked this by adding a transition to Done.

Open

Withdrawn

Merged

Backlog

In Analysis

In Refinement

Ready for Development

In Development

Code Review

Ready for Test

In Testing

Ready for Signoff

Done |

I’m familiar with building survival models, but have only ever built a couple of multi-state survival models. R supports several packages, which is the best one to use for this minimalist multi-state dataset?

The msm package is very much into state transition probabilities, or at least that is the impression I got from reading its manual. flexsurv and mstate are other packages I looked at. I decided to stay with the survival package, the default for simpler problems; the manuals contained lots of examples and some of them appeared similar to my problem.

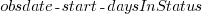

Each row of work item information in the Jira snapshot looks something like the following:

X daysInStatus start status obsdate 1 0.53 2020-05-12 In Development 2020-05-18 |

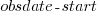

This work item transitioned from state Ready for Development at time  to state In Development at time

to state In Development at time  , and was still in state In Development at time

, and was still in state In Development at time  (when the snapshot was taken); the

(when the snapshot was taken); the  is a small interval used to separate the states.

is a small interval used to separate the states.

As is often the case with R packages, most of the work went into figuring out how to call the library functions with the data formatted just so, plus of course my own misunderstandings. Once the data was cleaned and process, the analysis was one line of code plus one to print the results; for instance, to estimate the mean time in each state by story-point value (code+data):

sp_fit=survfit(Surv(tstop-tstart, state) ~ sp, data=merged_status) print(sp_fit) |

Given the uncertainties in this model building process, I’m not going to discuss the results. This post is a proof of concept, which others can apply when the sequence of states is known with some degree of confidence, and good reasons for noise in the data are available.

Estimating quantities from several hundred to several thousand

How much influence do anchoring and financial incentives have on estimation accuracy?

Anchoring is a cognitive bias which occurs when a decision is influenced by irrelevant information. For instance, a study by John Horton asked 196 subjects to estimate the number of dots in a displayed image, but before providing their estimate subjects had to specify whether they thought the number of dots was higher/lower than a number also displayed on-screen (this was randomly generated for each subject).

How many dots do you estimate appear in the plot below?

Estimates are often round numbers, and 46% of dot estimates had the form of a round number. The plot below shows the anchor value seen by each subject and their corresponding estimate of the number of dots (the image always contained five hundred dots, like the one above), with round number estimates in same color rows (e.g., 250, 300, 500, 600; code+data):

How much influence does the anchor value have on the estimated number of dots?

One way of measuring the anchor’s influence is to model the estimate based on the anchor value. The fitted regression equation  explains 11% of the variance in the data. If the higher/lower choice is included the model, 44% of the variance is explained; higher equation is:

explains 11% of the variance in the data. If the higher/lower choice is included the model, 44% of the variance is explained; higher equation is:  and lower equation is:

and lower equation is:  (a multiplicative model has a similar goodness of fit), i.e., the anchor has three-times the impact when it is thought to be an underestimate.

(a multiplicative model has a similar goodness of fit), i.e., the anchor has three-times the impact when it is thought to be an underestimate.

How much would estimation accuracy improve if subjects’ were given the option of being rewarded for more accurate answers, and no anchor is present?

A second experiment offered subjects the choice of either an unconditional payment of $2.50 or a payment of $5.00 if their answer was in the top 50% of estimates made (labelled as the risk condition).

The 196 subjects saw up to seven images (65 only saw one), with the number of dots varying from 310 to 8,200. The plot below shows actual number of dots against estimated dots, for all subjects; blue/green line shows  , and red line shows the fitted regression model

, and red line shows the fitted regression model  (code+data):

(code+data):

The variance in the estimated number of dots is very high and increases with increasing actual dot count, however, this behavior is consistent with the increasing variance seen for images containing under 100 dots.

Estimates were not more accurate in those cases where subjects chose the risk payment option. This is not surprising, performance improvements require feedback, and subjects were not given any feedback on the accuracy of their estimates.

Of the 86 subjects estimating dots in three or more images, 44% always estimated low and 16% always high. Subjects always estimating low/high also occurs in software task estimates.

Estimation patterns previously discussed on this blog have involved estimated values below 100. This post has investigated patterns in estimates ranging from several hundred to several thousand. Patterns seen include extensive use of round numbers and increasing estimate variance with increasing actual value; all seen in previous posts.

Recent Comments