Archive

High value IP auctions, finally a way to moneterise the blockchain

Team High-value-IP-auctions (Gary, Shlomie and yours truly) were at Hackcoin today. We targeted the opposite end of the market from Team Long Tail Licensing, i.e., high value at very low volume rather than low value at high volume.

One of the event sponsors was Nxt, a cryptocurrency I had not previously heard of. Nxt is unusual in that it is exclusively focused on the use of the blockchain as a tool for building applications, there is no mining to create new currency (it is based on proof-of-stake, which was all distributed at genesis). I was surprised at how well developed the software and documentation appeared to be (a five hour hack does not leave time for a detailed analysis).

So you have some very interesting information and want to provide a wealthy individual the opportunity to purchase exclusive access to it. There is a possibility that the individual concerned might not be very sporting about this opportunity and it would be prudent for the seller to remain anonymous throughout the negotiation and payment process.

A cryptocurrency blockchain is the perfect place to deposit information for which a global audience might be needed at some point in the future. The information can be stored in encrypted form (where it can hide in plain sight with all the other encrypted content), it will be rapidly distributed to a wide variety of independent systems and following a few simple rules allows the originating source to remain anonymous.

The wealthy individual gets sent details on how to read the information (i.e., a decryption key and a link to the appropriate block in the blockchain) and the Nxt account number where the requested purchase price should be deposited.

Once events have been set in motion the seller may not have reliable access to the Internet and would prefer a third party to handle the details.

The third party could be a monitor program running in the cloud (perhaps independent copies running on Amazon, Azure and Google to provide redundancy). This monitor program sleeps until the end of the offer period and then sends a request for the current balance on the account being used. If the account does not contain the purchase price, the encryption key and appropriate link is tweeted, otherwise the monitor program shuts itself down.

Those of you who don’t have any information that wealthy individuals might want to purchase could use this approach to run a kick-starter campaign, or any sale of digital goods that involved triggering product release after a minimum monetary amount is reached within a given amount of time.

Does the third party monitor program have to run outside of a blockchain environment? Perhaps it could be executed as a smart contract inside a crytpocurrency such as Ethereum. I did see mention of smart contracts inside Nxt, but unless I missed something they are not supported by the base API.

The designers of the Nxt blockchain have appreciated that they need a mechanism to stop it becoming weighed down by long dead information. The solution is pruned data, data that is removed from the blockchain after a period of time (the idea that a blockchain is an immutable database is great in theory, but dooms any implementation to eventual stasis).

Does our wealthy individual have any alternative options? Perhaps the information is copyright and the lawyers can be unleashed. I doubt that lawyers could prevent the information being revealed in this case, but copyright infringement via the blockchain is an issue that has yet to explode on the world.

The implementation was surprisingly straightforward and the only feature not yet working at the time of our presentation was tweeting of encryption key. We won first prize of 1-bitcoin!

Ethereum: Is it cost effective to create reliable contracts?

The idea of embedding of a virtual machine supporting user executable code inside a cryptocurrency continues to fascinate me. I attended the Ethereum workshop on using Solidity to develop dapps (distributed apps) yesterday.

Solidity seems to have been settled on as the high-level language in which programs for the EVM (Ethereum Virtual Machine) will be written, at least at launch. While Ethereum appear to know what they are doing in the design of the cryptocurrency (at least to my non-expert eyes), they are rank amateurs at language design. A good place to start learning is the rationales for Ada, Eiffel and Frink for starters.

Ethereum uses the term Contracts to describe programs executed by the EVM.

Anybody publishing a Contract that involves transferring something that has a real-world impact on their financial state (e.g., funds in cryptocurrency that are exchangeable for government backed currency) will want a high degree of confidence in the reliability of the code.

It is easy to imagine that people will be actively reverse engineering all published Contracts looking for flaws that can be exploited to siphon off funds into their personal accounts.

Writing high reliability code is time consuming and expensive. One way of reducing time/cost is to use a language that implicitly performs lots of checking, rather than requiring the developer to insert lots of explicit checks.

The following is an example of a variable definition providing information to the compiler that can be used to insert checks in the generated code (e.g., that no value outside the range 1 to 1000 is assigned to amount_to_pay); the developer does to not need to worry about explicitly adding checks in all the necessary places. This language functionality was invented in 1970 (in Pascal) but went out of fashion, for new languages, in the 1990s.

var amount_to_pay : 1..1000;

Languages such as Ada and Frink improve program reliability by providing functionality that reduces the effort developers need to invest in checking for unintended behavior.

Whatever language the code is written in, what happens if an attempt is made to assign 1001 to amount_to_pay? It does not matter whether the check is implicit or explicit, an error has occurred and has to be handled. As a developer of this code I want to know about the error (so I can fix it) and as a user of the code I do not want to lose money for executing a failed transaction.

At the moment the only Ethereum error handling solution I can think of is writing error information to the blockchain (in place of the information that would have been written on successful program execution); the user will still get charged for executing the program but at least will now have the evidence needed to obtain a refund (the user has to be charged to prevent denial of service attacks using Contracts containing a known fault).

I wonder who will find it worthwhile investing in creating the high reliability code needed for Contracts to be a viable solution to a problem?

Long tail licensing

Team ‘Long Tail Licensing’ (Richard, Pavel, Gary and yours truly) took part in the Fintech startupbootcamp hackathon at the weekend.

As the team name suggests the plan was to implement a system of payment and licensing for products in the long tail, i.e., a large number of low value products. Paypal is good for long tail payment but does not provide a way for third parties to verify that a transaction has occurred (in fact Paypal does its best to keep transactions secret from everybody except those directly involved).

Our example use case was licensing of individual Github repositories. Most of today’s 3.4 million developers with accounts on Github would rather add more features to their code than try to sell it; the 16.7 million repositories definitely qualifies as a long tail of low value products (i.e., under £100). Yes, Paypal could be (and is) used as a method of obtaining payment, but there is no friction-free method for handling licensing (e.g., providing proof of licensing to third parties).

Long Tail Licensing’s implementation used cryptocurrency for both payment and proof of licensing (by storing license information in the blockchain). For the hackathon we set up out own private Bitcoin blockchain to act as a test rig, supply fast mining and provide near instantaneous response.

To use Long Term Licensing a developer creates the file .cryptolicense in the top level directory of their repo; this file contain information on the amount to pay, cryptocurrency account details and text of licensing terms. A link in the README.md file points at our server, which validates the .cryptocurrency file and sets up a payment transaction from the licensee’s Bitcoin wallet; the licensee confirms the transaction and the payment is made.

The developer’s chosen license information is included in the transactions blockchain, providing the paperwork that third-parties can view to verify what has been licensed. This licensing information could be in plain text or use public key encryption to restrict who can read it (e.g., eBay could publish a public key that third parties could encrypt information so that only eBay’s compliance department could read it).

The implementation code includes links to private servers and other stuff that it should not be be; hackathon code is rarely written with security in mind. So those involved would rather it not be pushed to Github (perhaps it will get tidied up and made suitable for public consumption at a later date).

We did not win any of the prizes :-(. Well done to Manoj (a frequent hackathon collaborator) and his team for winning the $100k of Google cloud time prize.

Ethereum contracts, is the design viable?

I went to a workshop run by Ethereum today, to learn about cryptocurrency/virtual currency from a developer’s point of view. Ethereum can be thought of as Bitcoin+contracts; they are also doing various things to address some of the design problems experienced by Bitcoin. This article is about the contract component of Ethereum, which is being promoted as its unique selling point.

The Ethereum people talk so much about contacts that I thought once currency (known as ether, a finney is a thousandth of an ether, with other names going down to  ) had been mined it was not considered legal tender until it was associated with the execution of a contract. In fact people will be free to mine as many ethers as they like without having any involvement with the contract side of things.

) had been mined it was not considered legal tender until it was associated with the execution of a contract. In fact people will be free to mine as many ethers as they like without having any involvement with the contract side of things.

Ethereum expect the computational cost of mining to be significantly greater than the cost of executing contracts.

A contract is a self-contained piece of code created by a client and executed by a miner (the client pays the miner for this service). The result of executing the contract is added to the data associated with a block of mined currency (only one contract per block).

How confident can the client, and interested third parties, be that the miner paid to execute the contract is telling the truth and didn’t make up the data included in the mined currency block?

The solution adopted by Ethereum is to require all miners involved in the execution of contracts to execute all contracts that have been associated with mined currency, so that the result posted by the miner who got paid to execute each contract can be validated (51% agreement is required).

For this design to work, the cost of executing contracts to verify the data produced by other miners has to be small relative to paid income received from executing contracts.

If somebody is in the ether mining business, executing contracts has the potential to provide additional income for a small increase in effort, i.e., the currency has been mined why not get paid to execute contracts, adding the resulting data to blocks that have been mined?

Ethereum has specified the relative cost of operations executed by the Ethereum Virtual Machine. The Client specifies a value used to multiply these costs to produce an actual cost per operation that are willing to pay.

Requiring the community of contract executors to execute all contracts creates a possible vulnerability that can be exploited.

To profit from executing contracts the following condition must hold:

where:  is the ratio of unpaid to paid contracts,

is the ratio of unpaid to paid contracts,  is the average number of operations performed per contract,

is the average number of operations performed per contract,  is the average execution cost per operation and

is the average execution cost per operation and  is the average amount clients pay per operation.

is the average amount clients pay per operation.

This simplifies to:

What would be a reasonable estimate for  , the ratio of unpaid to paid contracts? Would 1,000 miners offering contract execution services be a reasonable number? If we assume that contracts are evenly distributed among everybody involved in contract execution, then there are disincentives of scale; every new market entrant reduces income and increases costs for existing members.

, the ratio of unpaid to paid contracts? Would 1,000 miners offering contract execution services be a reasonable number? If we assume that contracts are evenly distributed among everybody involved in contract execution, then there are disincentives of scale; every new market entrant reduces income and increases costs for existing members.

What if businessman Bob wants to corner the contract market and decides to drive up the cost of executing contracts for all miners except himself? To do this he enlists the help of accomplice Alice as a client offering contracts at extremely poorly paid rates, which Bob is happy to accept and be paid for appearing to execute them (Alice has told him the result of executing the contracts); these contracts are expensive to execute, but Bob and Alice know number theory and don’t need a computer to figure out the results.

So Bob, Alice and all their university chums flood the Ethereum currency world with expensive to compute contracts. What conditions need to hold for them to continue profiting from executing contracts?

Lets assume that expensive contracts dominate, then the profitability condition becomes:

where:  is the increase in the number of contracts,

is the increase in the number of contracts,  the increase in the average number of operations performed per contract and

the increase in the average number of operations performed per contract and  the increase in average execution cost per operation.

the increase in average execution cost per operation.

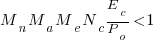

This simplifies to:

What values do we assign to the three multipliers:  ? Lets say

? Lets say  , which tells us that the price paid has to increase by a factor of 150 for those involved in the market to maintain the same profit level.

, which tells us that the price paid has to increase by a factor of 150 for those involved in the market to maintain the same profit level.

Given that Ethereum are making such a big fuss about contracts I had expected the language being used to express contracts to be tailored to that task. No such luck. Serpent is superficially Python-like, with the latest release moving in a Perl-ish direction, not in themselves a problem. The problem is that the languages is not business oriented, let alone contract oriented, and is really just a collection of features bolted together (the self absorbed use case for the new float type: “… elliptic curve signature pubkey recovery code…”, says it all). Another Ethereum language Mutan is claimed to be C-like; well, it does use curly brackets rather than indentation to denote scope.

If Ethereum does fly, then there is an opportunity for somebody to add-on a domain specific language for contracts, one that has the kind of built in checks that anybody involved with contracting will want to use t prevent expensive mistakes being made.

Recent Comments